Since mid-2022, it’s been impossible to open the Wall Street Journal or turn on CNBC without hearing economic concerns: tech layoffs, rising interest rates, inflation risks, bank failures, etc. Other than a brief window during the first half of 2020, these issues represent the heaviest economic headwinds businesses have experienced since 2008.

Not surprisingly, these concerns cause many business leaders to reexamine their growth plans. Should we pause investing in that new greenfield facility? Is this a good time to delay hiring plans? Should we forgo a planned merger?

Admittedly, all of those are completely rational ideas and very tempting based on the current business environment. But as Matt Damon famously reminded us – “fortune favors the brave” (although it’s probably best not to think too hard about what industry he was advertising when he made that statement).

From our seat supporting middle-market life sciences organizations through acquisitions, we’ve seen several key shifts in the market landscape over the past year – all of which favor following Matt Damon’s advice:

- After a half-decade of rising valuations, we’ve finally seen prices start to normalize. For decades, the consensus was that 3x – 5x revenue was a reasonable back-of-the-envelope valuation estimate for young post-revenue organizations. However, over the past few years, we’ve routinely seen these same companies being sold for 10x – 20x revenue – and in some cases, even more. Many industry leaders wondered whether this was the new normal. But for the first time in years, we are seeing significant downward pressure on valuations. For example, I recently talked to an executive who had explored an acquisition in 2018 when the seller was asking $200M for their $15M organization; that acquisition never occurred, and that same company just sold for $75M with similar revenue and EBITDA.

- Similarly, we are seeing more motivated sellers than we have in the past decade. Growth-stage companies have experienced a near-endless supply of accessible capital to fund future growth in recent years, spurred by low interest rates and eager investors. As those sources of funds are drying up, more sellers are exploring alternative ways to fund their future growth, which sometimes means being acquired. As evidence – healthcare-related PE investments in the US have remained stable at a cumulative value of $100-120B for several years, before spiking to over $200B recently. (source: Pitchbook)

- Many organizations are experiencing economic headwinds and are searching for creative ways to achieve aggressive growth targets for 2023. A smart strategic acquisition, combined with a well-structured integration plan, can be a great way to inject new momentum into an organization’s commercial activity.

How To De-Risk Acquisitions

Despite the incentives to pursue inorganic growth, acquisitions carry inherent risks. While risks are impossible to eliminate, they can be significantly mitigated using a series of best practices that we employ with our clients.

1. Have a Clear Vision.

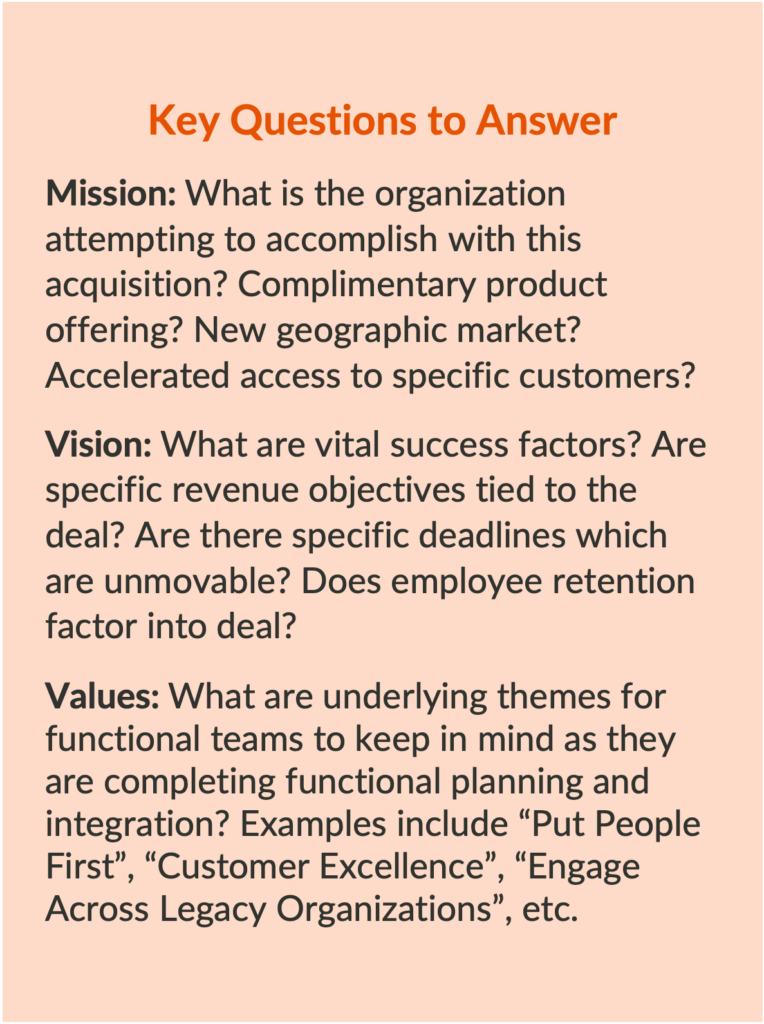

On all M&A transactions, we start by walking through a process of developing the vision, mission, and values of the transaction. This process can feel unnecessary to our clients, who recognize the vast amount of work ahead and want to get started quickly. While understandable, we encourage the executive leadership to take time to document these key principles. Deal teams often expand as we move from diligence to Day 1 planning to integration, and many team members will be serving in specific functional roles without the 30,000-ft view of what the deal is trying to accomplish at the macro level. Publishing the underlying principles guiding the deal is a vital way for leadership to inform and remind the team how their role aligns with the overall vision of the deal.

2. Keep It Simple

Transactions are natural times of transition. The team will be expecting the introduction of new colleagues, new customers, new processes, new products, and a general sense of change in the air. Some leaders view this as an opportunity to execute on ancillary changes which have previously been planned but faced organizational reluctance. While this perspective is understandable, it can be a distraction. When team members are hearing a variety of priorities during a deal, it becomes easier to lose sight of the underlying deal thesis or otherwise distract the team from the deal’s key objectives.

We recommend limiting acquisition priorities to those which are vital for the success of the transaction and integration. This list is typically long enough without additional complications. We partner with our clients to identify a series of key transition phases:

- What must be built/implemented prior to Day 1?

- What changes should be completed within the first 30 days?

- What other short-term priorities should be targeted for days 31-90?

- What additional long-term changes should be completed after 90 days to achieve the future-state vision?

Each of these conversations are held first by the functional teams, who compile the above lists. Then we partner with the leadership teams at both the buyer and seller to consolidate the lists, identify key functional interdependencies, resolve conflicts, reprioritize where appropriate, and publish a master acquisition workplan.

3. Execute on the Plan

The final step is perhaps the easiest to comprehend, but also the most common to leave incomplete. Oftentimes a huge amount of energy and attention is expended around the beginning of an acquisition lifecycle – during diligence and integration planning, continuing through Day 1. This attention is vital due to the number of moving pieces around the hurried planning period and rapid change.

However, where motivation and thought are plentiful in the early phases, we often see activity levels drop during the 2nd and 3rd months post-close. As integration leaders and team leaders settle into their ‘new normal,’ it is common to see a decrease in integration work cadence as business-as-usual activities again become priorities.

To keep attention on the integration and ensure key deal objectives are reached, we recommend integration leadership adopts a systematic project management structure (often branded as an “Integration Management Office”). This includes the use of standardized planning processes and tools, regular reporting schedules, and documented governance structures.

Utilizing a standardized structure across functional workstreams provides better visibility for leadership into whether timelines are being achieved and allows for decisions to be made in real-time to recast plans or reassign resources. In addition, by combining a well-structured integration plan and a process to assure continued attention towards achieving those project plan objectives, a leadership team can ensure the appropriate activity and attention remain in place – thus assuring that deal objectives are achieved in a way that is minimally invasive to ongoing business activities.

Conclusion

In summary, while M&A carries inherent risks, the benefits of a well-executed and managed acquisition can exponentially accelerate business growth. Conversely, a poorly executed acquisition can create complex challenges and defocus the core business. Therefore, having a trusted partner and a well-thought-out plan through the critical stages of an acquisition is vital and will maximize the probability of success of any transaction.

CREO has helped dozens of middle-market organizations reach their acquisition growth objectives. If your organization is currently considering or undertaking a transaction, we’d welcome the opportunity to discuss additional best practices and observations with you. Reach out to Kurtis Roush, our Director of M&A, to schedule a time to chat (kroush@creoinc.net). Or schedule a meeting with him directly at https://calendly.com/kjroush.